Unlocking Key HSR Second Request Data

April 7, 2022

|

By:

The landscape for Hart-Scott-Rodino (HSR) filings has undergone immense flux over the last two years. The economic upheaval of the COVID-19 pandemic and regulatory shifts of a new presidential administration have impacted both the volume of large merger and acquisition (M&A) transactions and the scrutiny they receive from regulatory agencies. This makes it hard for businesses and law firms to know what to expect from upcoming M&As, including the likelihood of receiving a Second Request and how regulators will handle that investigation.

Data on recent Second Requests can help by giving parties at least a general sense of what their peers are experiencing. Official numbers for 2021 won’t be published until autumn of this year — but we can look at past trends to try to predict those numbers to a reasonable degree.

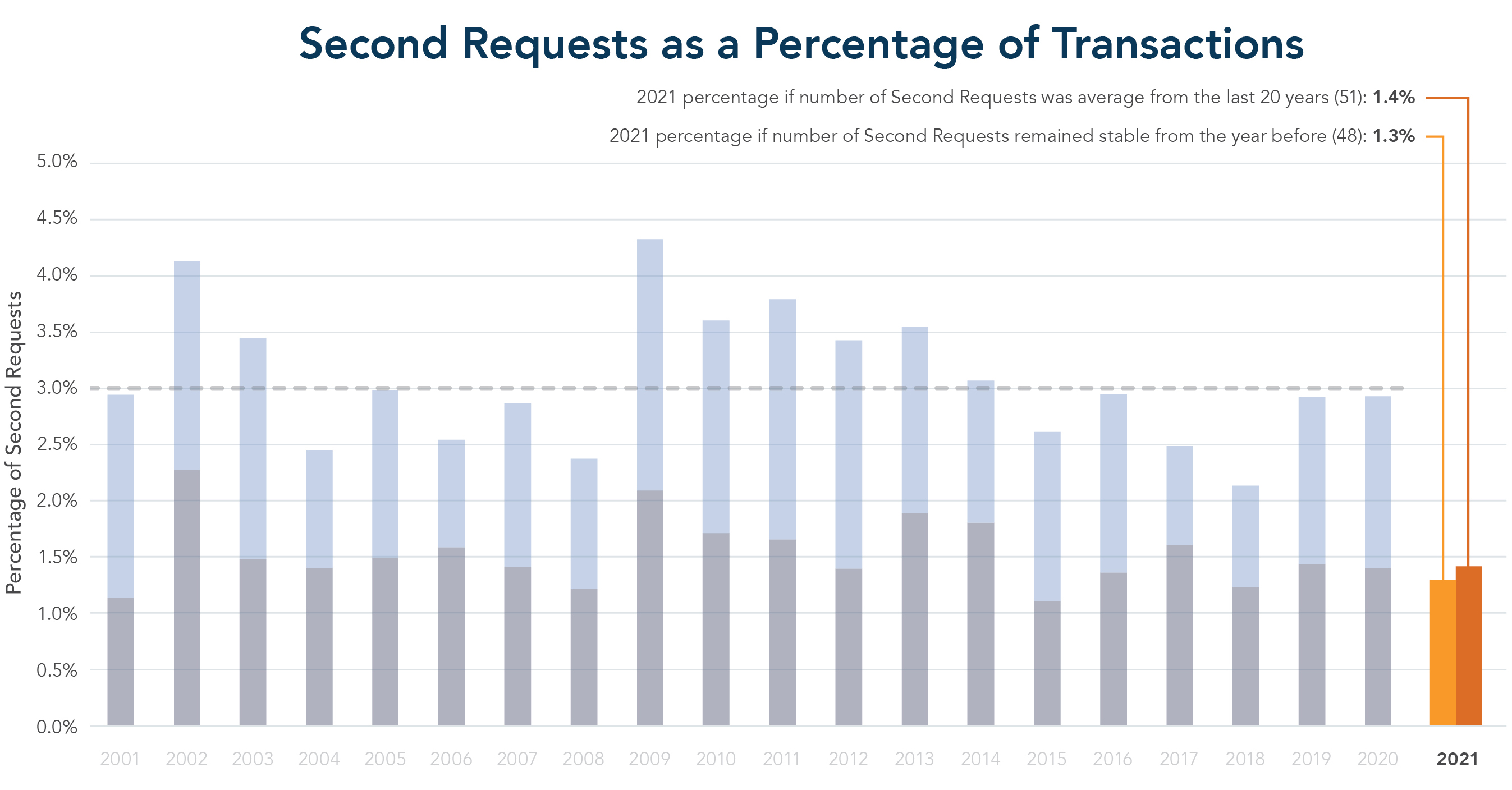

A close reading of historical data and current context suggests something of a paradox: The number of Second Requests in 2021 was likely fairly high but, at the same time, may have represented a historically small share of the year’s HSR filings. This is due to the extraordinary surge in HSR transactions and other factors, which are summarized below. For a full analysis, see our 2021 Second Request Trends Report.

HSR filings plummet and rebound amid pandemic

In 2020, the economic lockdown and business hesitancy caused by the COVID-19 pandemic brought HSR filings to their lowest total in 7 years. The Federal Trade Commission (FTC) and Department of Justice (DOJ) reported 1,673 filings for the year, of which 48 resulted in Second Requests. While this is less than the 61 Second Requests issued in 2019, it reflects the same annual percentage. That rate of 3% is slightly higher than the rates in both 2017 and 2018, which landed between 2 and 2.5%.

Then, the economy surged in late 2020 and early 2021, bringing HSR filings with it. Preliminary data from federal agencies show HSR filings in 2021 more than doubled from the year before, reaching 3,644.

Second Requests in 2021 likely resembled 2020

Most likely, the number of Second Requests in 2021 was close to the total in 2020. However, that means the percentage rate of Second Requests versus total HSR filings likely dropped significantly, by half or more.

This is because maintaining the 3% rate from 2019-2020 seems unattainable. At that rate, agencies would have to investigate more than 100 proposed M&As — far beyond anything we’ve seen in the last 20 years.

It’s also far too many for the FTC and DOJ to manage, given their recent struggles with capacity. Since December 2020, both agencies have made multiple budget requests and policy changes to help them keep up with the volume of transactions and workload associated with them. For example, FTC officials have publicly called for more time to review filings, saying the traditional review period of 30 days hasn’t, “kept pace with the increased volume and complexity of transactions and their related data and documents.”

A more realistic rate for 2021, therefore, is somewhere between 1 and 2%. That would produce around 50 Second Requests — a total consistent with last year, as well as the average annual number over the last 20 years.

HSR is more complex for everyone

While HSR filings have clearly bounced back from their dip in 2020, the overall Second Request landscape is marked by complexity and uncertainty. Officials continue to make and seek revisions to regulations, making the terms of engagement a moving target. The soaring data volumes and diverse data sources cited by the FTC pose challenges for companies as well, who may find it increasingly difficult and expensive to meet HSR deadlines and other requirements.

This was evident in a recent survey conducted by Lighthouse of more than 100 experts from corporations and law firms, who selected the following challenges as top of mind during the Second Request process:

- Getting the data in and processed quickly

- Ensuring the deal goes through

- Producing quickly

- Choosing the right technology

These responses underscore the need for parties to accurately read the landscape and leverage outside tools and expertise to improve speed and efficiency.

For a deeper dive into the Second Request landscape, including insights from experienced attorneys in the field, a detailed primer on regulatory changes, and what to expect in the current year, check out our 2021 Second Request Trends Report.